This post was originally published on Changepoint’s blog as part of their new series of interviews with project practitioners, Changepoint Practitioners. Thanks for sharing!

Portfolio managers play a vital role within organizations, yet there are some myths around the role and its intrinsic value. The value of portfolio managers is often misunderstood and understated — often as a result of too much emphasis being placed on projects and execution, rather than portfolios as a whole and how they drive strategic initiatives to desired outcomes.

Now is the time for us project portfolio managers to refocus and enforce a portfolio mindset. Entire portfolios can fail even if projects are completed successfully, and it becomes drastically clearer in times of forced change and crisis. The strategic imperatives and business outcomes of our organizations depend on it.

The biggest myth about portfolio management

Portfolio management = a set of projects, programs, and requests

Most people think of the portfolio manager as an extremely senior project manager. In part, this is because most definitions describe a portfolio as a set of projects, programs, and the requests that comprise them. It’s also because many people grow into the role in this way; they started out as a project manager, progressed to program manager, and eventually became a portfolio manager. Unfortunately, this natural progression fosters a mindset that’s focused on breaking things into elements and examining each one rather than focusing on the whole.

Portfolio management can get stuck in statuses, work breakdown, and schedules because that’s what organizations know. I believe that there’s a need to change this mindset within organizations to make the connection between portfolio management, strategy, and execution. It’s about saying, “I’m not a project manager; yes, I can do that, if that’s what you want me to do, but my best value lies in knowing how to drive the doers and execution, and how to take your message and make sure teams are executing on the right things.”

How outdated thinking impacts effectiveness

I’ve noticed that many portfolio managers who were previously very tactical, often need some help to think from a strategic standpoint.

What happens when you’re not focusing on the top-down?

As the typical portfolio manager grew into the role of being a project manager, they’re not necessarily used to focusing on anything other than the trees; they’re looking at the funnel and focusing on the execution, rather than giving focus to the health of their portfolio.

Just because all the projects in the portfolio are executing green doesn’t mean that your portfolio is green. If you have a whole set of projects that are all being executed very well but are not achieving the direction of the leadership’s strategy, then you have a set of projects that are not meeting higher-level requirements. As a portfolio manager, it’s your responsibility to understand where everything is and start to drive improvements.

What should a portfolio manager’s focus be?

A portfolio manager should be managing a set of opportunities that have plans in place in which a leader wants to invest.

People tend to treat portfolio management like a plant nursery where they’re setting everything up in rows like a gardener. They need to look more like the forester who’s out there planting an entirely new forest with the hope of it looking like a naturally wild landscape in a few short years.

The portfolio manager’s role is about leadership and should be connected to the executives, tied to the strategy, vision, and the investment that your organization is trying to drive. Instead of looking at the elements as just driving execution and making sure execution is working, you need to think about how to improve the overall machine so it can run more efficiently and provide a top-down view of how everything’s working coherently.

If you can make portfolios focus on the finance side, [listening to what finance is looking at and, what drives them when it comes to budget], then you can build your investments and select projects that are tied to the overall strategy.

Oftentimes the first thing that needs to be changed is the thought process — that you have a services application and you’re going to take that to your end-users, and then turning that into your portfolio intake mechanism. This just continues to drive bottom-up behavior, creating an environment whereby you’re seen as a services provider and not a strategic enabler. You need to look at things from the strategic, top-down perspective.

Re-focusing PPM to support opportunities

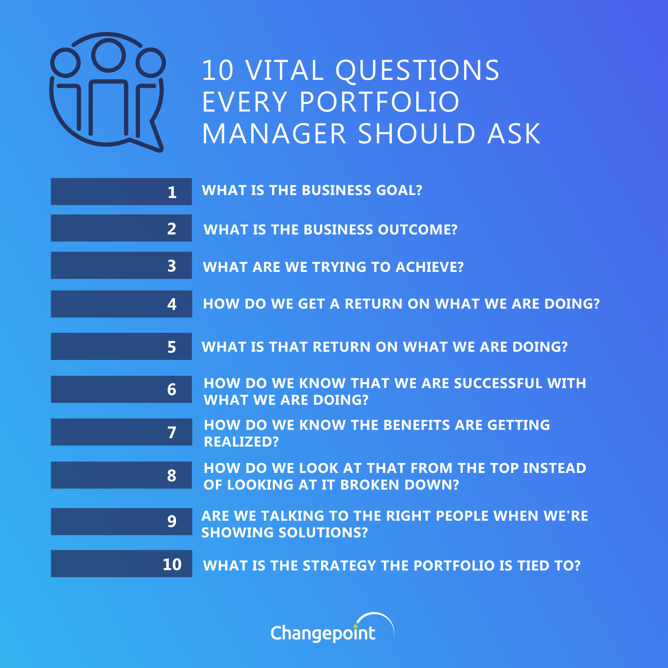

It’s important to look at the things you’re doing as part of your portfolio or which could be done in the portfolio. As projects, programs, and services requests carry baggage, start to call things opportunities, and look at them from a different perspective. Ask yourself:

- What are the opportunities that we need to capture in order to have better sales numbers?

- What are the opportunities that we need to focus on in order to drive down costs?

- What are the opportunities we need to focus on because of our changing business climate?

This is about more than just annual planning and sitting down at the annual workshops. This is about organizations having a defined strategy, with clear drivers and vision towards that strategy, and then ensuring your portfolio supports that. Research opportunities are important also. Instead of just making investments you should also be conducting research. Ask yourself, ’What kinds of things can we do?’ And, ’Am I managing research opportunities?’, which is much different.

In all of this, there still needs to be a well-oiled machine that’s taking care of execution, and it has to run well. As a portfolio manager, you need to ensure that the machine receives preventative maintenance periodically. Instead of driving and assuring execution is working, it’s pertinent for portfolio managers to think about how to maintain that machine so it can run better.

Strategy and execution aren’t as simple as setting up a PMO and having a portfolio with prioritized projects that fall into a funnel. Something might erroneously get approved that doesn’t necessarily meet the overall strategy. It’s essential that a portfolio manager raise awareness of issues like this with the leadership team to stop silo creation.

Leadership role in strategy and supporting portfolio management

It’s natural for leaders to be comfortable with projects and programs that have a concrete beginning and end dates – that’s how most work gets done between managing projects and facilities, making sales, creating partnerships, and so on. Portfolios, on the other hand, are much different in that they don’t have end dates. Most projects and programs start and finish, but portfolios persist.

This is where having a well-defined strategy is so important so that once the strategy is defined projects and programs can be aligned to it. As a unit, executives need to ensure alignment is maintained and should regularly ask, “Is this project part of our strategy or is there a risk to us changing our strategy?” Executives need to understand that to meet an organization’s desired numbers, the overall strategy may need to change.

This is why a portfolio focus from the top-down is so important as not only will these changes put pressure on a portfolio manager, it will put pressure on the business in terms of changing resource allocations, investments, and so on, that require alignment.

3 steps to transitioning efforts toward opportunities to become truly value-driven

The whole PPM transition process should be centered around organizational development, mentoring, patience, and learning from failures. It can lead to an organization that is strategy-focused, nimble, and swiftly able to adapt. Here are three steps to help organizations in this transition:

1. Clarify benefits realization

One major element is to anchor on benefits realization and identifying how a project or program has achieved its supposed benefits. This is the first aspect that the leadership team should task to portfolio managers. Why? The reason benefits realization is so hard to track is because of projects end, teams disband, and nobody’s left to determine whether anticipated outcomes were actually achieved. By asking your portfolio manager to own benefits realization you’ll ensure projects have business cases with real hard benefits that can really drive through the organization.

This helps the portfolio manager to zoom in on opportunities: they identify the projects with strong business cases—those that were driving value and benefits back to the organization.

2. Find your champion

Given the importance of having a clear strategy to enable the portfolio manager to accomplish their role, it’s critical that someone on the leadership team recognizes its value. Don’t be afraid to take that seat at the table and remind them that as executives the business is our responsibility and we need to decide the strategy and how we’re going to drive it. You’re there to help make sure that they’re doing that.

3. Learn from past experience

If you have someone who’s taken that journey, it’s helpful if you can learn from them. At another organization, I started out looking at the different ways we did things in the past to help us become more strategic, like lean manufacturing, agile, and others. When we made the commitment to make things visible, it started to change the way we made decisions and helped us transition our focus to value-driven opportunities.

Changing the focus of PPM requires removing outdated thinking, asking tough strategic questions, developing a top-down strategic approach, focusing on benefits realization, and finding executives to champion your PPM efforts.